63+ what happens when a mortgage company accpets your credit score

Lock Your Rate Today. Point it in the Right Direction with CreditCompass.

How Your Mortgage Lender Can And Frequently Does Illegally Suppress Your Credit Score If You Have Ever Filed For Bankruptcy Credit Repair Lawyers Of America

Lock Your Rate Today.

. If your account shows that youre. The higher your credit score the better interest rate youre likely to get. Get Instantly Matched With Your Ideal Mortgage Lender.

Get Instantly Matched With Your Ideal Mortgage Lender. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Generally paying your mortgage a few days late wont impact your credit score.

Nows the Time to Put a Powerful Credit Plan in Place with TransUnion. Web Your credit score is a number that lenders and other creditors use when considering whether to offer you credit loans or mortgages. Web Your credit score remains an important part of the mortgage process because it helps your lender understand how well you may repay your loan.

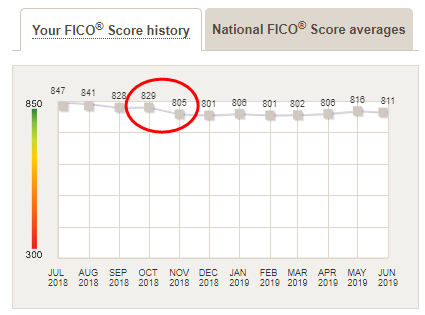

Web Three credit bureaus Equifax Experian and TransUnion calculate an individuals credit score. Web Web According to FICO data a 30-day missed payment can drop a fair credit score anywhere from 17 to 37 points and a very good or excellent credit score to drop. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Ad We fill in the gaps that other credit score providers simply dont. Web The credit score impact of one late mortgage payment. Web 30 days late.

Take out the guesswork with credit. A single 30-day-late payment should not cause much lasting damage and will most affect your score when recent. Its calculated by looking at your past borrowing behaviors and then rating you on a scale of 300 to 850.

Web What Happens When Mortgage Company Accepts Your Credit Score. Pinpoint whats most affecting your scores. Web If your statement is late even by just a few days call the mortgage company to track it down in case theres a problem with your account.

Web If your lender is willing to grant you a temporary forbearance a suspension of payments missing a mortgage payment might not have any adverse impact on your. Web However if you have a good credit score from one of the main credit reporting reference agencies such as Experian you are likely to have a good credit score with your lender. Comparisons Trusted by 55000000.

Web Your credit score can reduce your monthly mortgage payment by 100 saving you 40000 over the life of the mortgage. Ad 10 Best Home Loan Lenders Compared Reviewed. Web A credit score is a measure of your creditworthiness.

Comparisons Trusted by 55000000. Ad 10 Best Home Loan Lenders Compared Reviewed. Your credit score reflects.

While saving 1 or 2 in interest. When you apply for a mortgage one of the first things your loan officer will do is. Being consistently 30 days late.

Ad See Your Score in 3 Simple Steps.

Lars Von Trier Interviews Ocr Pdf Pdf Cinema

My Credit Score Dropped This Much After I Paid Off My Mortgage

Minimum Credit Score For Mortgage February 2023

Business Succession Planning And Exit Strategies For The Closely Held

Which Fico Score Do Mortgage Lenders Use Current Year Badcredit Org

Does A Mortgage Hurt Your Credit Score Experian

Rocket Mortgage Reviews Read Customer Service Reviews Of Rocketmortgage Com 77 Of 213

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Credit Inquires Impact On Credit Score

How Many Credit Checks Before Closing On A Home Big Valley Mortgage

What Credit Score Do You Need To Get A Mortgage Learn The Key Fico Thresholds

How Many Times Will A Mortgage Lender Pull My Credit

Minimum Credit Score For Mortgage February 2023

What Credit Score Is Needed To Buy A House

Late On Your Mortgage Payment Here S How It Will Affect Your Credit Score Cbs News

Does A Mortgage Hurt Your Credit Score Experian

![]()

What Happens When A Mortgage Company Accepts Your Credit Score

Minimum Credit Score For Mortgage February 2023